Fed to struggle inflation with fastest charge hikes in decades

Warning: Undefined variable $post_id in /home/webpages/lima-city/booktips/wordpress_de-2022-03-17-33f52d/wp-content/themes/fast-press/single.php on line 26

WASHINGTON (AP) — The Federal Reserve is poised this week to speed up its most drastic steps in three many years to assault inflation by making it costlier to borrow — for a automobile, a house, a business deal, a bank card purchase — all of which can compound Americans’ monetary strains and certain weaken the economic system.

But with inflation having surged to a 40-year excessive, the Fed has come underneath extraordinary strain to act aggressively to sluggish spending and curb the worth spikes which are bedeviling households and firms.

After its newest rate-setting assembly ends Wednesday, the Fed will almost certainly announce that it’s elevating its benchmark short-term interest rate by a half-percentage level — the sharpest price hike since 2000. The Fed will probably perform one other half-point rate hike at its subsequent meeting in June and presumably on the subsequent one after that, in July. Economists foresee nonetheless additional fee hikes within the months to comply with.

What’s extra, the Fed can be anticipated to announce Wednesday that it'll start shortly shrinking its huge stockpile of Treasury and mortgage bonds beginning in June — a move that may have the impact of additional tightening credit score.

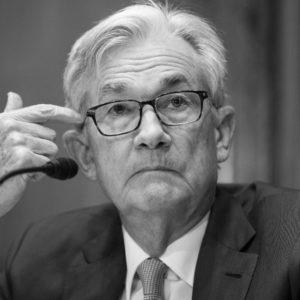

Chair Jerome Powell and the Fed will take these steps largely at midnight. No one knows simply how high the central bank’s short-term fee must go to gradual the financial system and restrain inflation. Nor do the officers know the way a lot they can scale back the Fed’s unprecedented $9 trillion steadiness sheet earlier than they threat destabilizing financial markets.

“I liken it to driving in reverse whereas utilizing the rear-view mirror,” stated Diane Swonk, chief economist at the consulting firm Grant Thornton. “They just don’t know what obstacles they’re going to hit.”

But many economists suppose the Fed is already performing too late. Even as inflation has soared, the Fed’s benchmark price is in a variety of just 0.25% to 0.5%, a degree low sufficient to stimulate development. Adjusted for inflation, the Fed’s key rate — which influences many client and enterprise loans — is deep in negative territory.

That’s why Powell and different Fed officials have stated in recent weeks that they want to elevate rates “expeditiously,” to a degree that neither boosts nor restrains the financial system — what economists discuss with because the “neutral” rate. Policymakers think about a neutral rate to be roughly 2.4%. However no one is certain what the impartial price is at any specific time, particularly in an economic system that's evolving quickly.

If, as most economists count on, the Fed this 12 months carries out three half-point fee hikes after which follows with three quarter-point hikes, its rate would attain roughly neutral by yr’s finish. These will increase would quantity to the quickest pace of price hikes since 1989, famous Roberto Perli, an economist at Piper Sandler.

Even dovish Fed officials, similar to Charles Evans, president of the Federal Reserve Financial institution of Chicago, have endorsed that path. (Fed “doves” usually prefer protecting charges low to assist hiring, while “hawks” usually help higher rates to curb inflation.)

Powell mentioned final week that once the Fed reaches its impartial price, it may then tighten credit score even further — to a degree that would restrain growth — “if that turns out to be acceptable.” Monetary markets are pricing in a fee as excessive as 3.6% by mid-2023, which would be the best in 15 years.

Expectations for the Fed’s path have change into clearer over simply the past few months as inflation has intensified. That’s a sharp shift from just a few month in the past: After the Fed met in January, Powell stated, “It's not doable to foretell with a lot confidence precisely what path for our policy fee goes to show acceptable.”

Jon Steinsson, an economics professor on the University of California, Berkeley, thinks the Fed should present extra formal guidance, given how briskly the financial system is changing within the aftermath of the pandemic recession and Russia’s struggle against Ukraine, which has exacerbated provide shortages across the world. The Fed’s most recent formal forecast, in March, had projected seven quarter-point fee hikes this year — a pace that's already hopelessly out of date.

Steinsson, who in early January had referred to as for a quarter-point enhance at every assembly this year, mentioned last week, “It is applicable to do things fast to send the signal that a pretty significant amount of tightening is needed.”

One challenge the Fed faces is that the impartial price is even more uncertain now than usual. When the Fed’s key price reached 2.25% to 2.5% in 2018, it triggered a drop-off in dwelling gross sales and financial markets fell. The Powell Fed responded by doing a U-turn: It minimize rates thrice in 2019. That experience recommended that the neutral price might be decrease than the Fed thinks.

However given how much costs have since spiked, thereby reducing inflation-adjusted rates of interest, no matter Fed rate would truly gradual growth is perhaps far above 2.4%.

Shrinking the Fed’s steadiness sheet adds another uncertainty. That's notably true on condition that the Fed is expected to let $95 billion of securities roll off each month as they mature. That’s almost double the $50 billion pace it maintained earlier than the pandemic, the last time it decreased its bond holdings.

“Turning two knobs on the similar time does make it a bit more difficult,” stated Ellen Gaske, lead economist at PGIM Mounted Earnings.

Brett Ryan, an economist at Deutsche Financial institution, said the balance-sheet reduction can be roughly equivalent to 3 quarter-point will increase by way of subsequent 12 months. When added to the anticipated charge hikes, that may translate into about 4 percentage factors of tightening by way of 2023. Such a dramatic step-up in borrowing costs would send the economy into recession by late subsequent year, Deutsche Financial institution forecasts.

Yet Powell is counting on the robust job market and stable shopper spending to spare the U.S. such a fate. Although the economic system shrank within the January-March quarter by a 1.4% annual charge, businesses and customers elevated their spending at a solid tempo.

If sustained, that spending could maintain the economy expanding within the coming months and perhaps beyond.